It makes my blood boil.

Since March I’ve been screaming about the Fed’s total misreading of inflation — believing it’s being caused by workers getting wage hikes, when the real cause is powerful corporations raising prices higher than their costs.

I’m not so grandiose as to think my screams would have any direct influence on the Fed. My hope was that my argument and data might be picked up by a few voices in the media, which would lead some Democrats in Congress to pick up on it, and that maybe they’d put some pressure on the Fed — such as asking Fed chief Jerome Powell to respond to those arguments when he next testifies.

It’s not happened yet. Yesterday Powell and the Fed raised interest rates again — another three-quarters of a percent — bringing the official rate from near zero in March to over 3 percent now.

Insane.

Well, now I get a chance to tell Congress why this is insane.

The House Oversight Committee’s subcommittee on economic and consumer policy holds a hearing this morning and has asked me to testify. (Thankfully, they’re allowing me to do it remotely from my home here in California, although the timing isn’t ideal — the hearing starts 9 am Eastern Time, which is 6 am here — and because I’m the lead-off witness they want me to check in remotely at 5:45 am. I’ll have to drink plenty of coffee.)

When you testify before Congress, you get 5 minutes to summarize your views. You submit your detailed testimony, which is read by the committee’s staff, who then give members of Congress questions to ask you based on the submitted testimony (the Democratic staff’s questions are usually quite different from Republican staff’s). Those questions, hopefully, allow you to get into the details.

My aim is to state as clearly as possible that the underlying problem is not wage-price inflation. It’s profit-price inflation. And the Fed’s continuing rate hikes will hurt average workers by slowing the economy — making it harder for workers to get wage increases and causing many to lose their jobs.

I’m going to suggest that Congress consider ways to control inflation that limit corporate profits rather than jobs and wages — such as a windfall profits tax, tougher antitrust enforcement, and even temporary price controls.

Will Congress do any of this? Here again, I’m not so full of myself as to think I can sway a single member of Congress, let alone Congress as a whole. But in my experience, policy ideas that are useful and timely often find their way into politics — eventually displacing old ones that are no longer useful and may be damaging.

At least that’s my hope with “profit-price” inflation replacing the anachronistic “wage-price” inflation.

I’m going to add my testimony to this post right after I testify this morning — and fill you in on what happened.

***

The hearing was just adjourned.

The good news is that the Democrats on the committee got it. They understood that big corporations raising their prices in excess of their costs — to score record profits — is a major reason for the inflation we’re now experiencing. And workers are paying for those record profits in two ways — real wage losses (wage gains have been more than offset by price increases, making most workers worse off) and by the higher prices themselves (the result of corporations increasing their profit margins).

I was particularly impressed by the chairman of the subcommittee, Representative Raja Krishnamoorthi (from the 8th district of Illinois), who understood the issues and expressed them cogently, and by Cori Bush (from the 1st district of Missouri), who asked terrific questions. Katie Porter did a fabulous job breaking the issue down.

There was less discussion of remedies than I’d hoped — only passing reference to tougher antitrust enforcement and no real discussion of a windfall profits tax — and no criticism of the Fed (other than in my remarks and testimony).

Not surprisingly, the Republicans on the committee were obstreperous and wildly partisan. All they did was try to blame inflation on the American Rescue Plan, Biden, and the Democrats. They repeatedly quoted Larry Summers’s misleading claim that pandemic spending fueled inflation (even at one point asking me if I served with him in the Clinton administration, without giving me the chance to rebut him). They asked the Republican witness, Tyler Goodspeed (briefly chair of Trump’s Council of Economic Advisors), to confirm their rhetorical questions but didn’t ask me a thing.

Like much of the rest of our governing processes, congressional hearings have degenerated into partisan posturing and name-calling. I experienced this starting in 1995 when Newt Gingrich became Speaker.

For those of you who might be interested, here’s the testimony I submitted this morning:

***

Mr. Chairman and members of the Committee,

My name is Robert Reich. I’m the Carmel P. Friesen Professor of Public Policy at the Goldman School of Public Policy, University of California, Berkeley.

Last week’s consumer price index report shows annual inflation in the United States still roaring at 8.3 percent annually [1] -- the worst breakout of inflation since the 1980s.

In response, the Fed has raised interest rates from near zero in March to over 3 percent yesterday, and has signaled it will keep raising rates until inflation is under control.

I believe this strategy is a mistake. It assumes the current inflation is being driven by wage hikes and a tight labor market. But the underlying problem is not wage-price inflation. It is profit-price inflation.

The Fed’s rate hikes are hurting average working Americans whose real wages are already falling. Congress should consider alternative ways to control inflation that focus on corporate profits rather than jobs and wages.

1. What’s causing the current inflation?

Inflation is not being driven by the usual suspects:

Don’t blame raw materials. The prices of commodities – wheat, natural gas, oil, and metals -- are falling.[2] That’s partly because of a global slowdown, particularly in China, that is reducing worldwide demand.

Don’t blame intermediate goods. Last Wednesday’s Bureau of Labor Statistics report on producer prices was fairly encouraging.[3] Even the prices of semiconductors and electronic components are slowing.[4]

Don’t blame inflationary expectations. Last week’s New York Fed survey of inflationary expectations [5] was very positive. Expectations of continuing inflation have declined across the board.

And – importantly -- it’s not wages.

Jerome Powell worries that “the labor market is extremely tight,”[6] and to “an unhealthy level.”[7] Some economists claim that inflation is “grounded in a red hot labor market.”[8]

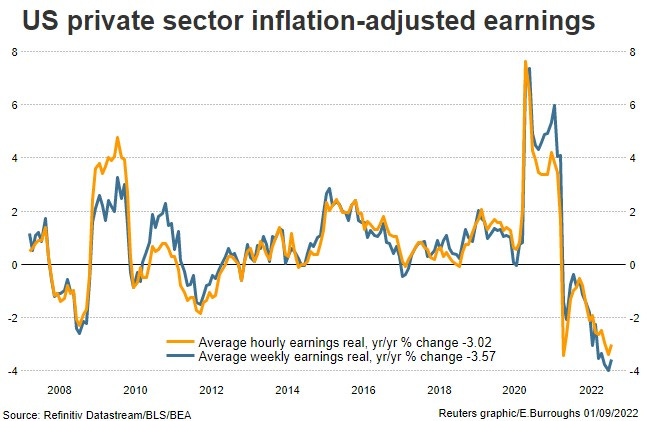

With due respect, this analysis is wrong. Although pay is still climbing, wage hikes have not kept up with inflation. This means most workers’ paychecks are shrinking, in terms of purchasing power. So rather than contributing to inflation, wages are reducing inflationary pressures.

As the accompanying graph shows, inflation-adjusted earnings have plunged.[9]

2. The underlying problem is profit-price inflation

What’s a major reason prices are rising? Corporations are increasing their profit margins.

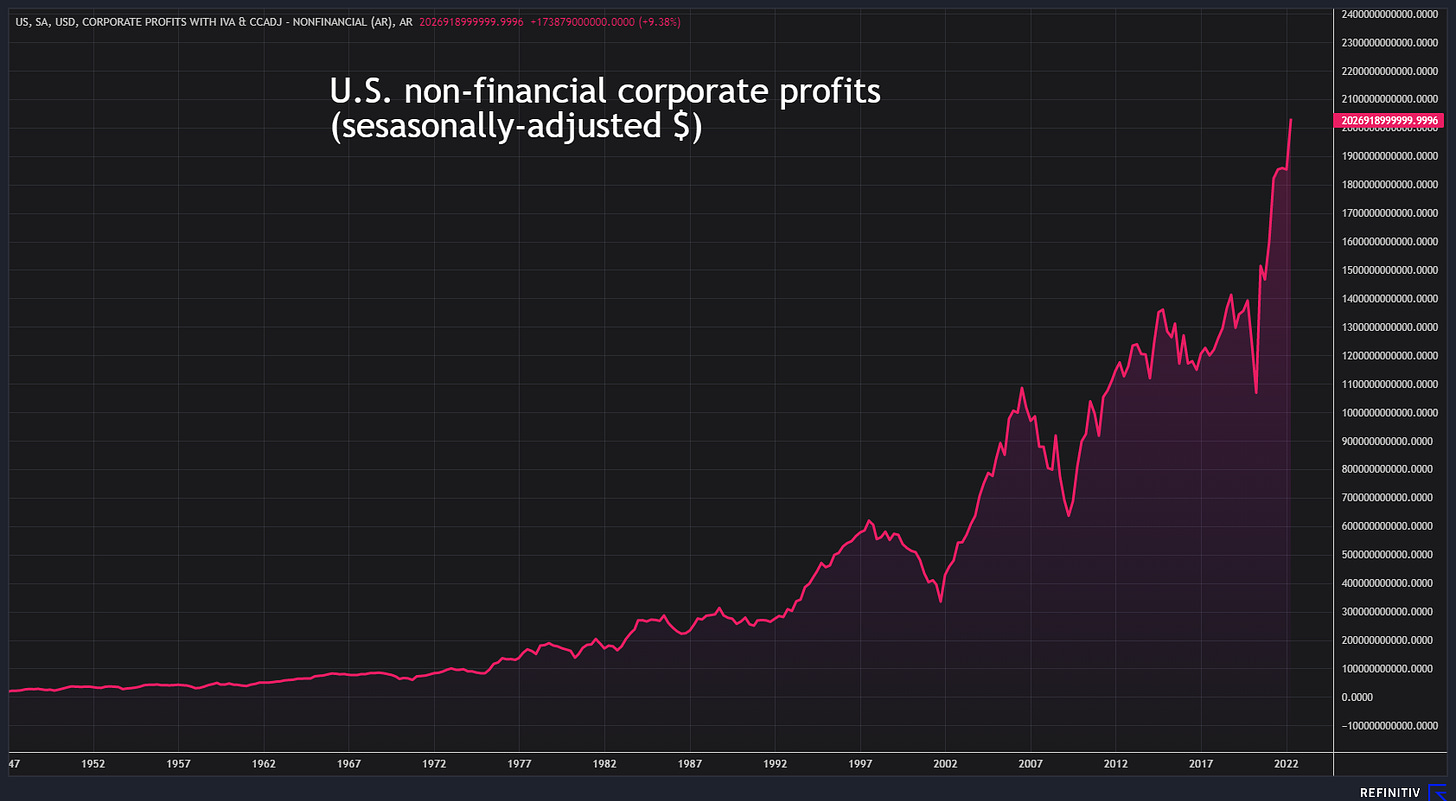

In the second quarter of this year, U.S. companies raked in profits that were the highest on record or close to levels not seen in over half a century. As a share of GDP, U.S. corporate profits in the second quarter rose to 12.25%, their highest levels since 1950. (See graph below)

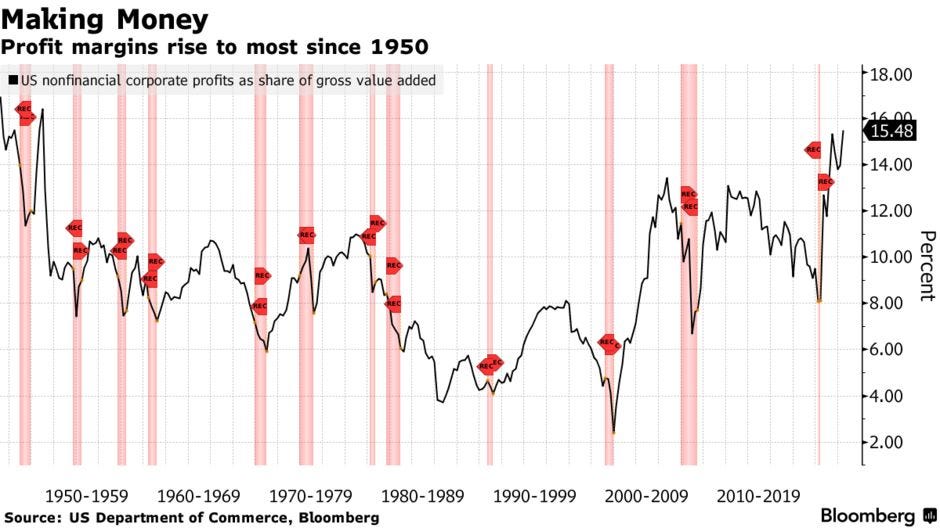

Notably, corporate profit margins – over and above costs – continue to grow. (See chart below.)

The labor market is not “unhealthily” tight, as Jerome Powell asserts. Corporations are unhealthily powerful.

In a normally competitive market, corporations would keep their prices down to prevent competitors from grabbing away customers. As the White House National Economic Council put it in a December report: “Businesses that face meaningful competition can’t [raise profit margins], because they would lose business to a competitor that did not hike its margins.”[10]

The underlying problem is that large American corporations have so much market power they can raise profit margins – and prices -- with impunity.

Since the 1980s, two-thirds of all American industries have become more concentrated.[11] This concentration gives corporations the power to raise prices because it makes it easy for them to coordinate price increases with the handful of other companies in their same industry, without risking the possibility of losing customers, who have no other choice.

For example, Monsanto now sets the prices for most of the nation’s seed corn. Wall Street has consolidated into five giant banks. Airlines have merged from 12 carriers in 1980 to four today, which now control 80 percent of domestic seating capacity. The merger of Boeing and McDonnell Douglas has left the US with just one large producer of civilian aircraft — Boeing. Three giant cable companies dominate broadband: Comcast, AT&T and Verizon. A handful of drug companies control the pharmaceutical industry. Two giant firms dominate consumer staples. A handful of national retailers and food outlets dominate local markets. And so on.

Such concentration makes it easy for corporations to raise their prices beyond what is required to offset rising input costs. More than half of the companies surveyed by the business services reviews website Digital.com reported raising prices beyond what was required to offset rising costs.[12]

As The New York Times pointed out, “corporate executives have spent recent earnings calls [with Wall Street analysts] bragging about their newfound power to raise prices, often predicting that it will last.”[13]

3. Examples from specific sectors

Take a closer look at specific sectors and you’ll see profit-price inflation in action:

Grocery prices are through the roof largely because just 4 companies – Archer-Daniels-Midland, Bunge, Cargill, and Louis Dreyfus, known collectively as ABCD – control an estimated 70 to 90 percent of the global grain trade,[14] making grain markets are even more concentrated than energy markets. All have raised their prices and gained record profits. Last year was Cargill’s most profitable year in its history, with almost $5 billion in net income.[15]

At the same time, just 4 companies control up to 85 percent of meat and poultry processing.[16] They too have raised prices above costs. Tyson’s net income soared 47 percent, while it spent $700 million in shareholder buybacks.[17]

Consumer packaged goods conglomerates -- such as Coca-Cola, Hershey’s, PepsiCo, and Mondelez – are also highly concentrated. And they too are raising prices and reporting record earnings.[18] Coca-Cola has credited its increased net operating revenues to price hikes. Procter and Gamble has boasted of the “biggest annual sales increase in 16 years” with its net earnings soaring to $14.7 billion following price hikes on all of its products. It has paid out over $19 billion to shareholders.[19]

Shipping conglomerates are expected to top last year’s profits by over 73 percent or $256 billion.[20] Here again, it’s because they have the power to raise prices. 80 percent of global merchandise is moved through the Big 3 shipping alliances. You can see a similar pattern in freight railroads. Over the last six years, the five largest railroad freight lines have increased their operating margins by over a third.[21]

The ten largest U.S. retailers – all enjoying significant market power – have raised consumer prices while collectively reporting $24.6 billion in increased profits during the last two fiscal years. These same companies also ramped up stock buybacks by nearly $45 billion year-over-year for a total of $79.1 billion.[22]

Gas prices are finally declining.[23] But they’re still high, and major oil companies continued to have enough pricing power to gain a whopping $46 billion in earnings in the second quarter of this year.[24]

It would be one thing if these corporations were investing their profits in additional capacity. At least this would reduce future inflationary pressures. But they have been using their profits to buy back their own shares of stock. This may be good for shareholders -- buybacks reduce a company's shares outstanding, raising its profits-per-share -- but it does nothing for the economy.

There is a direct historic analogy. At the end of World War II, when the United States attempted to shift back from war production to civilian production, it experienced bottlenecks similar to those caused by the pandemic. Then, as now, consumers had high pent-up demand for all sorts of products and services. Then, as now, large corporations with market power took advantage of limited supplies and soaring demand to increase their prices and enjoy windfall profits. Then, as now, inflation soared.

4. The Fed’s rate hikes are aimed at the wrong culprit

The Fed is using the only tool it possesses to fight inflation – interest rate hikes -- to do the one thing it has done in the past to fight inflation – slow the economy so real wages drop and unemployment rises.

But when inflation is being driven by corporate pricing power, the major consequence of Fed interest rate hikes is to further depress wages and limit jobs.

Rate hikes eventually diminish corporate profits because consumers have less money to spend on goods and services. But by then, average working people will have taken it on the chin. As the economy cools due to interest rate hikes, they are less likely to get wage increases that keep up with inflation. In consequence, they will fall further behind. As the economy slows and unemployment rises, average working people and the working poor will be the first to be fired and the last to be hired.

On August 26, Powell said the Fed must continue to raise interest rates, even though it will “bring some pain” to households.[25] How much pain? Researchers at the International Monetary fund estimate that unemployment may need to reach 7.5 percent -- double its current level -- to end the country's outbreak of high inflation. This would entail job losses of about 6 million people.[26]

Who will bear this pain? Not corporate executives, not Wall Street, not the wealthy and not the upper-middle class. It will be borne by average working people.

5. Better ways to stop profit-price inflation

In fairness to the Fed, it doesn’t have the tools it needs to prevent profit-price inflation. The responsibility falls on Congress and the administration to take on corporate pricing power directly through a windfall profits tax, bolder antitrust enforcement, and, if necessary, price controls.

Congress and the Biden administration enacted a 1 percent tax on stock buybacks in the recently enacted Inflation Reduction Act, along with a minimum corporate tax. These measures are important, but they don’t go far enough. They still leave most of the burden of fighting inflation on average working people and the poor.

A windfall profits tax would help. One way to structure it would be to place a temporarily tax on any price increases that exceed the producer price index – that is, the costs of producing consumer goods.

Congress could also direct the Federal Trade Commission to investigate whether prices reasonably reflect additional costs or amount to opportunistic price-gouging. The FTC already has the power to carry out such investigations and impose penalties under existing law.[27]

Bold antitrust enforcement is essential. Antitrust litigation is complex and time consuming (I directed the policy planning staff at the Federal Trade Commission in the Carter Administration and saw this firsthand). But the credible threat of aggressive antitrust enforcement can deter corporations from raising prices higher than their costs.

Congress must appropriate sufficient funds for the Antitrust Division of the Justice Department and the Bureau of Competition of the Federal Trade Commission to enable both agencies to attack excessive corporate concentration, which continues to harm workers and consumers.

Price controls should be a backstop. Price controls have many disadvantages, in terms of distorting markets and deterring investment. They worked well in World War II, less well in the 1970s when they were half-baked and badly executed.

But as I’ve argued, the current inflation is most directly analogous to what occurred immediately after World War II when supplies were still limited, pent-up demand had soared, and corporations were making windfall profits. At that time and under those circumstances, many of America’s most distinguished economists argued that price controls on important goods should continue temporarily, in order to buy the time necessary to overcome supply bottlenecks and prevent corporate profiteering.[28] They should be considered now, for the same reasons.

Conclusion

Congress and the administration have the power to stop corporations from using their market power to raise prices. It is far better that Congress and the administration take direct against this sort of inflation than relying solely on the Federal Reserve to raise interest rates to slow the economy and risk another recession – putting the entire burden on fighting inflation on average working people, who are not responsible for it.

[1] https://www.bls.gov/news.release/cpi.nr0.htm

[2] https://www.intellinews.com/commodity-prices-fall-across-the-board-as-the-market-adjusts-to-the-sanctions-realities-256384/

[3] https://www.bls.gov/news.release/ppi.nr0.htm

[4] https://www.theregister.com/2022/07/14/intel_plans_price_hikes_for/

[5] https://www.newyorkfed.org/newsevents/news/research/2022/20220912

[6] https://www.federalreserve.gov/newsevents/speech/powell20220321a.htm

[7] https://www.federalreserve.gov/newsevents/speech/powell2023221.htm

[8] https://www.nytimes.com/2022/09/15/business/economy/inflation-markets-economy.html

[9] Refinitiv Datastream/ BLS/ BEA. Reuters Graphic E. Burroughs.

[10] https://www.whitehouse.gov/briefing-room/blog/2021/12/10/recent-data-show-dominant-meat-processing-companies-are-taking-advantage-of-market-power-to-raise-prices-and-grow-profit-margins/

[11] https://hbr.org/2018/03/is-lack-of-competition-strangling-the-u-s-economy

[12] https://digital.com/half-of-retail-businesses-using-inflation-to-price-gouge/

[13] https://www.nytimes.com/2022/02/27/business/economy/price-increases-inflation.html

[14] https://www.theguardian.com/environment/2022/aug/23/record-profits-grain-firms-food-crisis-calls-windfall-tax?CMP=Share_iOSApp_Other

[15] https://accountable.us/meatpacking-profiteers-testifying-today-saw-nearly-13b-in-profits-after-racking-up-384m-in-price-fixing-fines-and-settlements/

[16] https://accountable.us/meatpacking-profiteers-testifying-today-saw-nearly-13b-in-profits-after-racking-up-384m-in-price-fixing-fines-and-settlements/

[17] https://accountable.us/meatpacking-profiteers-testifying-today-saw-nearly-13b-in-profits-after-racking-up-384m-in-price-fixing-fines-and-settlements/

[18] https://www.modernretail.co/retailers/citing-inflation-cpg-conglomerates-are-raising-prices-and-earning-record-profits/

[19] https://accountable.us/profiteering-watch-procter-gamble-boasts-biggest-annual-sales-increase-in-16-years-after-excessive-price-hikes/

[20] https://www.bloomberg.com/news/articles/2022-08-09/container-lines-to-smash-year-old-profit-record-with-73-surge

[21] https://www-wired-com.cdn.ampproject.org/c/s/www.wired.com/story/a-us-freight-rail-crisis-threatens-more-supply-chain-chaos/amp

[22] https://accountable.us/wp-content/uploads/2022/06/CPI-Retail-Report-Release.pdf

[23] https://www.forbes.com/sites/sergeiklebnikov/2022/09/07/oil-prices-hit-seven-month-low-as-recession-fears-weigh-on-demand

[24] https://www.nbcnews.com/business/business-news/oil-companies-record-earnings-sky-high-gas-prices-linge-rcna40622

[25] https://www.nytimes.com/2022/08/26/business/economy/jerome-powell-inflation.html?smid=nytcore-ios-share&referringSource=articleShare

[26] https://www.brookings.edu/bpea-articles/understanding-u-s-inflation-during-the-covid-era/

[27] https://www.congress.gov/bill/117th-congress/house-bill/675/text

[28] https://timesmachine.nytimes.com/timesmachine/1946/04/09/93087670.html?pageNumber=23

Share this post