Friends,

Yesterday I received the following email:

Employee of silicon valley bank here. Ironically I read Saving Capitalism and The System just in the last two months. I loved and enjoyed them although the topic is concerning of course.

And then this week watched my bank implode because they reached for the highest yield at the worst time to increase their stock price and triggered a shit storm for everyone.

I can't think of a better example of shareholder capitalism. Shareholders over depositors and employees. And of course regulators asleep behind the wheel.

Anyway not that you needed the validation but just wanted you to know from a reader of your work I am literally living through it now and you couldn't be more correct about the oligarchy and our current political/economic dilemma.

Thanks,

[name withheld]

President Biden is reassuring Americans that the U.S. banking industry is safe, saying that customers’ deposits will “be there when you need them.”

Well, yes. Deposits are safe, at least for now, because the Federal Reserve just set up a broad emergency lending program to ensure that all banks can meet the needs of their depositors.

But there’s a difference between insuring depositors and insuring banks.

People who deposit money in a bank should not have to exercise care in selecting which bank they deal with for fear that their deposits might vanish overnight. So it’s appropriate for the Fed to bail out depositors.

But executives of banks — whatever the size of those banks — should have to exercise care in what they do with those deposits. If the Fed bails out all banks that get in trouble, bankers have no incentive to be more careful. Their major incentive will continue to be to make as much money as possible for their shareholders (and thereby for themselves), even if they put their depositors’ money at unreasonable risk.

The short-term fix is to require smaller banks to follow the same rules as big banks under the Dodd-Frank Act — maintaining a minimum share of capital on hand to cover depositors and be able to pass stress tests.

Why don’t they now? Because the rules requiring small banks to do so were gutted during the Trump administration. Congress must pass legislation to restore these rules and prevent this from ever happening again.

But over the long term, this is no solution. For years, we’ve been playing whack-a-mole with banks. We regulate over here, and they shift risks onto the public over there.

Whenever the nation goes through a crisis or a near-crisis, as we did with the implosion of Silicon Valley Bank last Friday, there’s an opportunity to rethink fundamentals. Why are banks allowed to have shareholders at all? Doing so only serves to privatize the gains, and then, when a bank goes too far in maximizing shareholder returns, socialize the losses.

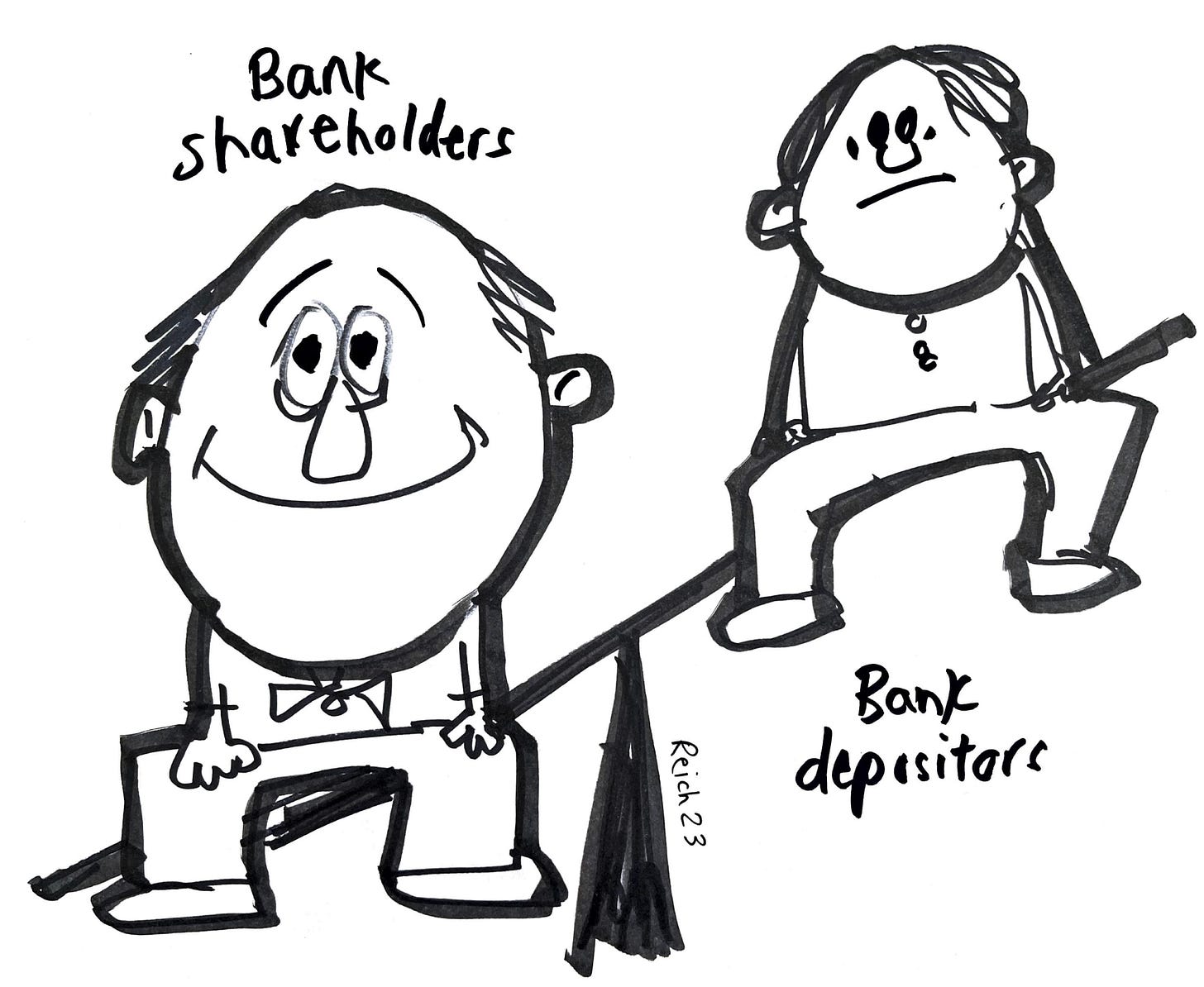

The fact is: The goal of maximizing shareholder returns is fundamentally at odds with the goal of protecting depositors.

It’s time to admit that banks that take in deposits are public institutions that shouldn’t gamble with those deposits. Regardless of size, no bank has the capital on hand to manage a sudden full-blown bank run. This is why, ever since the bank bailouts of 2008, the biggest banks have been “too big to fail.” And it’s why last weekend the government decided to backstop smaller banks, too.

Bankers want to hide this reality, but let’s face it: A bank charter is essentially a franchise from the government, a kind of outsourcing arrangement, to take in deposits and issue loans. That the Federal Deposit Insurance Corporation has the authority to instantly assume total control of a so-called “private” bank reveals the public nature of banking.

The Glass-Steagall Act was the law of the land until 1999. It prohibited banks from making profits off of the deposits entrusted to them. I say, bring it back!

What do you think?

Yes, Glass-Steagall should be reinstated but to do so would require an informed, patriotic Congress and a Supreme Court that rejects Citizens United. Woe is us.

Yes, bring back Glass-Steagall! As Elizabeth Warren said, make banking boring again.